Everyone knows trading is a very sophisticated profession. You might get easy access to the online trading community, but there is no assurance you will succeed as a trader. Thousands of traders have started their careers in the investment world, but most of them have failed miserably. If you want to protect your capital, you must learn to take trades in a standard way. Never take things aggressively in the learning stage. Though trading provides an insane amount of profit potential, you must learn to trade safely.

Elite traders always follow some common techniques to manage the risk exposure. Let’s learn about the actions of elite traders in Denmark and improve our risk management skills.

Be prepared to lose trades

Novice traders never think about the losing trades. They are always prepared to deal with winners. But the Forex market doesn’t work like this. A trader needs to understand that this market is all about probability. If you want to succeed as a full-time trader, you must consider the worst-case outcome of each trade. If you prepare yourself to lose money from a certain trade, you are not going to get frustrated after losing a few trades. This will make you more confident and let you deal with the losses in a systematic manner. Stick to your trading method and never break your own rules after losing a few trades.

Trade with the best broker

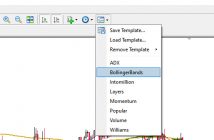

You must find a great broker to ensure a high-quality trading environment. Go to and try to learn about the features of a high-end broker. Once you open a trading account with a well-regulated broker, you can easily execute quality trades by using the advanced trading platform. But it takes time to learn the use of modern tools. As a learner, use the demo account first few months. Explore the tools and try to find a perfect way to use these tools. Never follow other people’s opinions or use a purchased trading system to trade the market. Use the demo account and develop your skills. Keep trading with a high-end broker so that you don’t have to deal with any unexpected losses.

The risk factor in each trade

You might be thinking that taking 2% risk in each trade is fair enough. But things don’t work like this. If you open 5 trades and risk 2% in each of them, you are risking 10% of your capital. No matter how good you are at trading, the overall risk exposure in the trades should never exceed 3% of your account balance. So, if you open two trades at the same time, you can risk 2% in one trade and in the other, you have to risk just 1% of the account balance.

Trade in the demo account for few months and you will realize why trading with high risk is so lethal. Always maintain a high risk to reward ratio in the trades so that you can cover your losing trades without having any major problems.

Trade with a simple strategy

To succeed as a trader, you need to trade with a simple strategy. Without using a simple trading method, you will lose track of trading. Many novice traders often love to trade with a complex trading method. To them, a complex trading strategy is more lucrative and they think it will help them to earn more. But in reality, a complex trading system always makes things difficult for rookies. As a novice trader, you will find it very challenging to analyze the critical market data within a short time by using a complicated method. Instead of that, if you rely on a simple trading system, you can easily improve your trade execution process and make better decisions. Most importantly, you can trade in a more relaxed way.