Forex trading can be a complex, but by utilizing technical indicators, traders can gain valuable insights into market trends and make more informed decisions. In this post, we will discuss the top technical indicators for successful forex trading.

1. Moving Averages

Moving Averages: A moving average is a trend-following indicator that shows the average price of a currency pair over a certain period of time. This can be useful in identifying key support and resistance levels, as well as determining the overall direction of the market. For example, if a 50-day moving average is above a 200-day moving average, this may indicate an upward trend.

2. Relative Strength Index (RSI)

Relative Strength Index (RSI): The RSI is a momentum indicator that compares the magnitude of recent gains to recent losses in order to determine overbought and oversold conditions. A value above 70 may indicate that a currency pair is overbought, while a value below 30 may indicate that it is oversold. This can be a useful tool for identifying potential entry and exit points for trades.

Example: Let’s say the RSI value for EUR/USD is currently at 80. This would indicate that the currency pair is in overbought territory and a potential sell signal. Traders may look to enter a short position or potentially take profits on any long positions they may have in the pair. Conversely, if the RSI value for EUR/USD is currently at 20, this would indicate that the currency pair is in oversold territory and a potential buy signal. Traders may look to enter a long position or potentially look for a reversal in the pair’s trend.

It’s worth noting that RSI should be used in combination with other technical analysis tools and not as standalone indicator.

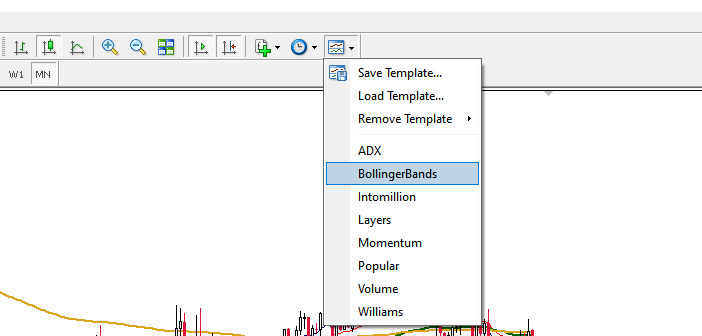

3. Bollinger Bands

Bollinger Bands are a volatility indicator that consist of a moving average and two standard deviation lines. The moving average is typically set to a 20-day simple moving average (SMA), but it can be adjusted to match the trader’s preference. The standard deviation lines are typically set 2 standard deviations above and below the moving average, but this can also be adjusted.

The bands will expand and contract based on market volatility. When the market is volatile, the bands will expand further apart, and when the market is less volatile, the bands will come closer together.

Bollinger Bands can be used in a number of ways to identify potential opportunities in the market.

- When the price of a currency pair is approaching the upper Bollinger Band, it may indicate that the market is overbought and a trend reversal is imminent.

- When the price of a currency pair is approaching the lower Bollinger Band, it may indicate that the market is oversold and a trend reversal is imminent.

- Bollinger Bands can also be used to identify potential breakouts when the price of a currency pair moves outside of the bands.

It’s worth noting that Bollinger Bands are a volatility indicator, which means that they will give signals based on how much a currency pair is moving, not on the direction of the move. Therefore, traders often use Bollinger Bands in conjunction with other technical indicators and analysis, such as trend lines and chart patterns, to confirm trades and avoid false signals.

Example: Assume that a trader is analyzing the EUR/USD currency pair and has set the Bollinger Bands with a 20-day simple moving average (SMA) and 2 standard deviations. The current price of the EUR/USD is 1.20 and the upper Bollinger Band is at 1.22 while the lower Bollinger Band is at 1.18.

- The trader observes that the price of the EUR/USD is approaching the upper Bollinger Band at 1.22. This may indicate that the market is overbought and a trend reversal is imminent. The trader may decide to enter a short position and set a stop loss order above the upper Bollinger Band at 1.23.

- Later, the price of the EUR/USD drops to 1.18, which is approaching the lower Bollinger Band. This may indicate that the market is oversold and a trend reversal is imminent. The trader may decide to enter a long position and set a stop loss order below the lower Bollinger Band at 1.17

- The price of EUR/USD goes outside of the Bollinger Bands, breaking above the upper band at 1.24, this may indicate a potential breakout. The trader may decide to enter a long position and set a stop loss order below the upper Bollinger Band at 1.22

4. Fibonacci retracement

The Fibonacci retracement indicator is a technical analysis tool that uses horizontal lines to indicate areas where a currency pair’s price may experience support or resistance. These levels are determined by the Fibonacci sequence, which is a series of numbers where each number is the sum of the two preceding ones, usually starting with 0 and 1. The most commonly used levels in Fibonacci retracement are 38.2%, 50% and 61.8%.

The Fibonacci retracement is used to identify potential levels where a currency pair’s price may experience a pullback or reversal after a significant move in price. These levels are often used to set entry and exit points for trades, as well as setting stop loss orders. Traders may also use these levels to identify potential profit taking levels.

Example: A trader spots an uptrend in the EUR/USD currency pair and decides to enter a long position at 1.20. They then use a Fibonacci retracement tool to identify key levels of support and resistance. The trader notices that the EUR/USD has retraced 61.8% of the move from 1.20 to 1.25 which is a common Fibonacci level, and decides to set a stop loss order at 1.19, just below that level. The trade is successful and the trader exits the position at 1.22, making a profit of 0.02

5. Stochastic oscillator

Stochastic oscillator: A trader notices that the GBP/USD currency pair has been in an overbought condition, as indicated by the stochastic oscillator with a value of 80. They decide to enter a short position at 1.40 and set a take profit level at 1.38, near a key support level that they have identified using other technical analysis tools. The trade is successful and the trader exits the position at 1.38, making a profit of 0.02

6. MACD (Moving Average Convergence Divergence)

Moving Average Convergence Divergence (MACD) is a technical indicator that is used to identify changes in momentum and trend direction. It is a trend-following momentum indicator that uses the difference between two moving averages to indicate a buy or sell signal.

The MACD is calculated by subtracting a 26-day exponential moving average (EMA) from a 12-day EMA. This difference is then plotted as a histogram and a signal line, which is a 9-day EMA of the MACD.

The MACD can be used to generate buy and sell signals in a number of ways.

- A bullish signal is generated when the MACD line (the 12-day EMA minus the 26-day EMA) crosses above the signal line (the 9-day EMA).

- A bearish signal is generated when the MACD line crosses below the signal line.

- Additionally, when the MACD line is above the zero line, it indicates bullish momentum while when it’s below the zero line, it indicates bearish momentum.

Another way of using the MACD is to look at the histogram, which is the difference between the MACD and the signal line, if the histogram is above zero, it indicates bullish momentum, if it’s below zero, it indicates bearish momentum.

Traders often use the MACD in conjunction with other technical indicators and analysis such as trend lines and chart patterns to confirm trades and avoid false signals. It’s important to note that the MACD is a lagging indicator, meaning that it will confirm a trend after it has started, instead of anticipating it.

Example: A trader is analyzing the AUD/USD currency pair and notices that the MACD indicator is showing a bearish crossover, indicating that the trend may be reversing from bullish to bearish. They decide to enter a short position at 0.78 and set a stop loss order at 0.79 above the recent high. The trade is successful and the trader exits the position at 0.77, making a profit of 0.01

7. Pivot Points

Pivot points are a technical analysis indicator used to determine key levels of support and resistance for a currency pair. These levels are calculated using the previous day’s high, low, and closing prices.

There are several different types of pivot points, the most common ones are:

- The central pivot point (also known as the “main pivot point”), which is the level at which the market is considered to be balanced.

- The first level of support (S1) and resistance (R1), which are calculated by adding and subtracting the difference between the main pivot point and the previous day’s high and low prices, respectively.

- The second level of support (S2) and resistance (R2), which are calculated by adding and subtracting twice the difference between the main pivot point and the previous day’s high and low prices, respectively.

Pivot points are used by traders to determine key levels where the market may experience a reversal or a continuation of a trend. These levels can be used to set entry and exit points for trades, as well as stop loss orders.

It’s worth noting that pivot points are considered as leading indicator and most traders use them in conjunction with other analysis like technical analysis and fundamental analysis. Additionally, it’s important to note that pivot points are calculated based on the previous day’s prices, so they may not be as accurate for markets that experience significant overnight gaps.

Example: A trader is monitoring the USD/JPY currency pair and notices that price is approaching a key pivot point level of 105. They decide to enter a long position at 105 and set a take profit level at 106, near the next resistance level. The trade is successful and the trader exits the position at 106, making a profit of 1.

Conclusion

While these indicators can be helpful in making informed trading decisions, it is important to remember that they should not be used in isolation. Traders should also consider other factors such as economic data releases, geopolitical events, and sentiment. Additionally, it’s advisable to use more than one indicator to confirm trades and avoid making false signals.

In conclusion, by utilizing technical indicators such as moving averages, RSI, and Bollinger bands, Fibonacci retracement, Stochastic oscillator, MACD and Pivot points forex traders can gain valuable insights into market trends and make more informed decisions. However, these indicators should be used in conjunction with other market analysis to confirm trades and avoid false signals.