A market analyst is an expert who will know tomorrow why the things he predicted yesterday haven’t happened today!

In this article, we’ll take a closer look at Forex brokers’ analytics. So, usually, our brain about to crash down after training with broker and book reading. New information is hard to comprehend and interest for studies is running out. Then, we – traders tend to look for an alternative way. And this way comes easily – market analytics provided by brokers absolutely free of charge might be very handy. Sounds right – what for to cram your head with stuff and nonsense? Read analytic reports and trade! However, in reality, this formula is not working. Let’s try to figure out why!

There is always a free cheese in a mousetrap!

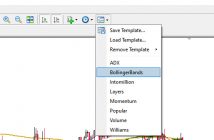

In general, analytics are divided into 2 groups:

- The ones who work with brokers. They follow brokers ideas – so, the clients trade as much as possible with bigger lots.

- Independent analytics. They are trying to get your interest by their forecasts and fell something afterward. For example, trading signals and expanded reviews.

A question comes naturally: if analytics are so smart why don’t they get rich at once following their own signals? The reason is – they have different tasks. That leads us to a conclusion: analytical review is just an instrument for full filing particular tasks.

Let’s review a typical analytics report. First thing comes – as Captain Obvious would say – overview of financial instruments recent moves. That’s right, but what’s the point? Further, you will find fundamental events calendar for today. A trader who trades by fundamentals already has this calendar, no need to show again. Then, signals on simple TS (trading system) are given, for example in case of trend channels breakouts. If EUR/USD breaks the support it goes down, if breaks resistance – go up. How exactly it’s going to happen? What to do in case of spike i.e. false breakout? Who said, particular TS works? Have you tried this out? Why do we believe in analytics at first place?

Analytics provide a point of view for beginners, that’s why they are so attracting. A beginner doesn’t know what to do at the moment – buy or sell? Analytics give their forecast. There is no risk. Actually, they can say anything, all risks go to the trader. For example, the same beginner can take an alternative forecast from other Forex brokers – with completely different levels and directions. Who is right and who is wrong? No one. Trust no one.

I like to analyze myself, but that is a very unrewarding thing to do. Every time you give an advice everyone remembers your mistakes and forgets all good advises. Even if you do have good advice people tend to be scary to follow them. Furthermore, it is quite hard to make annual forecasts – whip it out on request for every week, month, long term (according to the theory of probability). We are no Gods to know everything. You can’t say what will be on Forex in year or two time by following current market situation, can you? Only expectancy for Central Banks. Even they don’t know for sure or expressly keeping down the information. That is the reason why it’s better to trade with what you see, not what would you like to have (talking of forecasts). Forecasts tend to change and being reviewed often. Personally, I try to check not longer than a month forecasts on the currency market. Previous mistakes have thought me something! Having mistakes is too expensive on the market.

In addition, I would like to give a few recommendations:

- In case you need an advice better go straight to traders. Nowadays, you can find a lot of forums for that in internet.

- In case you believe in fundamental analysis, take Forex calendars and build your TS rules out of these calendars and lightning-fast forex news, not analytics.

- Do not believe in any TS except for your own, tested and known in the real trade. Check out all other TS properly. Do not trade according to simple analytics TS.