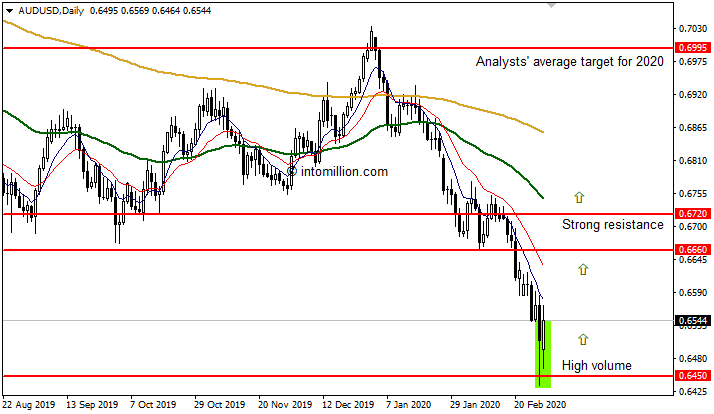

Australian Dollar during the total selloff last Friday (February 28) has touched an important support level at 0.6432 against US Dollar. The pair price didn’t break out this key resistance. The volume during the testing of this level was very high and the subsequent growth looks like the entrances of large buyers to long positions. The current AUD/USD pattern is very similar to the culmination of sales, which in turn gives hope for the beginning of a full-fledged pullback, which may well turn into a global reversal.

AUD/USD DAILY CHART

Moreover, the US Dollar positions against the background of rumors about FED interest rate reduction on 50 basis is extremely weak (Goldman Sees 50 bps Fed Cut in March). So our priority is long positions and we wait AUD/USD will continue its growth and break the local resistance level at 0.6550, followed by an exit up to 0.66 and higher. There is a probability that the Aussie will not reach the lower border of the channel at all (0.61 – 0.63), since too high volume was poured last Friday, which would allow the bears to continue the rally after a small pullback.

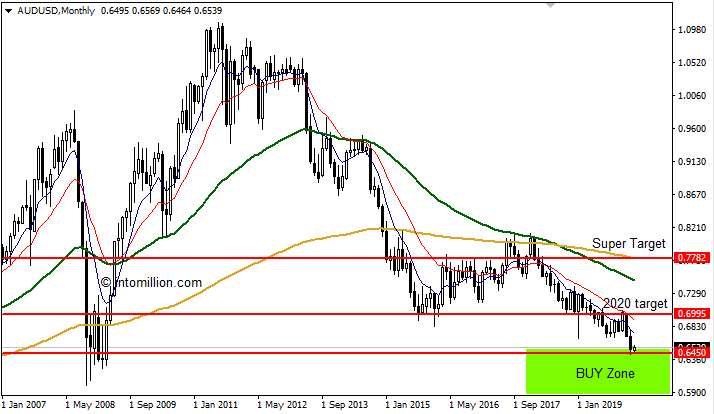

AUD/USD MONTHLY CHART

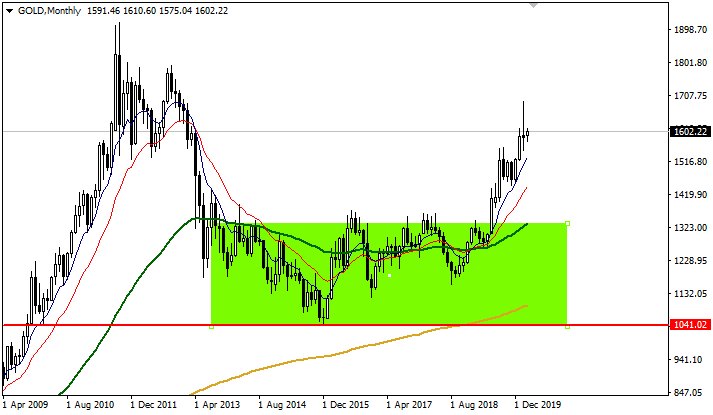

The currency pair of the Australian dollar vs US dollar is often referred to as a commodity coupling. In the case of the Australian dollar against US dollar, gold is served as a catalyst for the pair’s exchange rate valuation. Both the US and Australia play a significant role in global gold production, holding the second and third place respectively. Over the past couple of months, we have seen a strong negative correlation between the Australian dollar and gold against the background of pandemic and panic about the coronavirus. Look at the GOLD monthly chart below:

GOLD MONTHLY CHART

Factors that influenced the fall of the Australian Dollar for the past months

- The coronavirus continues to disrupt the global economy, especially in China and other Pacific countries, including Australia.

- The Australian economy, as well as the AUD rate, strongly depend on its Asian neighbor – China, as most of Australian exports are shipped to China. The USA – China trade war exacted a heavy toll on the Australian economy. In October 2019, the AUD/USD pair fell to a decade-long low of 0.6670. The trade tensions relief boost the market’s sentiment. The more progress in the US-China relationship, the higher the chances the commodity-driven Australia will get economically stronger.

- Australia fires – bushfire crisis. The Moody’s economist Katrina Ell said the fires would further cripple Australia’s already weak consumer confidence, increasing the chances of a rate cut next month, as well as causing damage to the economy through increased air pollution and direct harm to industries such as farming and tourism.

- The market brings forward Reserve Bank of Australia rate cut expectations

Despite all the fears and panic in the market around the coronavirus, we have re-entered in BUY on AUD/USD @ 0.6485 after a strong rebound of the pair from the level of 0.6432 on Friday (February 28). The Aussie remains heavily oversold against the US Dollar.

According to the recent FXStreet survey, the Aussie has a modest bullish bias. Analyzing the AUD to USD forecast poll 2020, experts suggest the average AUD/USD exchange rate in 2020 will be 0.6969 in the first half of 2020 and will reach 0.7000 by the end of 2020.

Start trading now! We recommend out true ECN and DMA Australian broker with almost zero spreads and 1:500 leverage. Reviewed and awarded by Intomillion team. Fast execution, perfect for scalping. Find out more on FP Markets Review