Monthly Chart

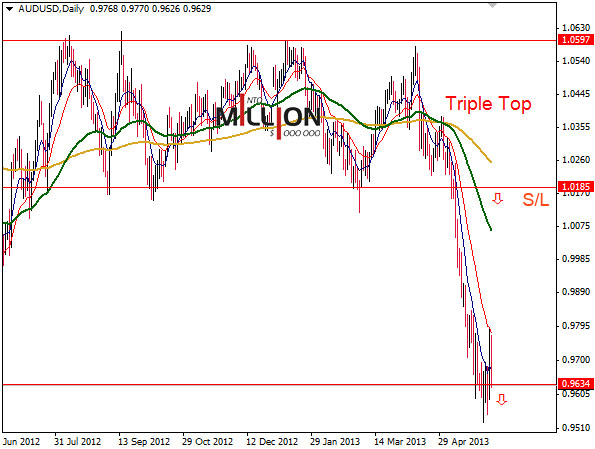

Daily Chart

Preference:

Short positions below 1.0150 with targets 0.9200 – 0.8850

Period of Time:

1 – 5 Months

Basis:

- Triple Top breakout on Daily chart

- The price on Weekly and Daily charts is under EMA 200.

- Bearish Candle with long body on May/2013 Chart.

- Expectation of AUD Further monetary policy easing (cash rate reduce).

- Narrowing of the yield spread between benchmark US and Australian 10-year bond yields. This implies an Aussie-negative realignment of investors’ perceptions of relative returns to be had from holding one currency over the other.

- Ausie is getting weak versus EUR, GBP, NZD and other currencies.

- Possible QE3 ending program and USD Federal funds rate increase.

- Steel and gold prices under pressure.

- China’s Zero-Growth Economy (main trading partner).